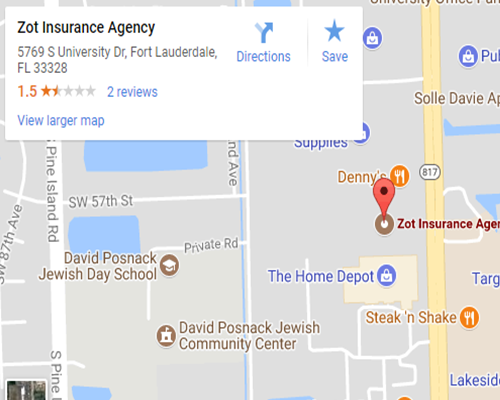

If you don’t mind long days on the road, trucking is a fantastic profession that’s vital to the economy. Here at Zot Insurance Agency in Davie, FL, we spend a lot of time connecting truckers with insurance that meets their needs, so here’s our quick trucking insurance 101.

What Kind of Insurance Does a Trucker Need?

Because truckers have a particular combination of business and auto coverage needs, their usual coverage is grouped together under commercial trucking insurance. With this coverage, the policy will typically cover damage done to or caused by your truck, the trailer, the cargo. This tends to include the medical bills for anyone injured by you. Every policy is different, so make sure to check the coverage and compare your options.

Travel Distance Matters

Driving further puts your truck and cargo at more risk. Trucking policies tend to have an operating radius where your coverage applies. Be clear with your agent about where you plan to operate and communicate any changes to avoid the brunt of full liability.

General Transport Versus Specialty Trucking

The type of cargo you haul has a large impact on the pricing of your insurance policy coverage. A trucker who takes a variety of jobs with no clear idea of the cargo will need general coverage. If your shipping is specialized to one product, you get a rate based on how volatile and valuable that cargo is. Hauling loads of cabbages doesn’t have the same risk involved as driving a car carrier trailer full of luxury vehicles.

Keep Your Eyes on the Road

There are enough distractions out there that your insurance coverage doesn’t need to add another one. Contact Zot Insurance Agency in Davie, FL for more information on how commercial trucking insurance works or to shop for a policy.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions