Whether you change your car’s oil yourself or you head to your local service station, there’s no way around it—the cost of oil changes can add up. Many people wonder whether it’s safe to go longer than the recommended interval between oil changes. Here’s what you need to know.

Check Your Owner’s Manual

The standard advice used to be that all cars needed an oil change about every 3,000 miles. Today, however, that’s not necessarily the gold standard.

Many modern cars can go between 5,000 and 7,500 miles between oil changes, and some synthetic oil vehicles can go 10,000 miles or more. Sticking to the interval recommended by your car’s owner’s manual is best.

Consider Your Driving Habits

Certain driving habits—like spending long periods of time sitting in traffic, driving in extreme temperatures, towing heavy loads, or taking frequent, short trips—make your engine work harder. If you have any of these driving habits, you may want to stick to the 5,000-mile mark for each oil change, even if you’re using synthetic oil.

Consider Timing—Not Just Mileage

If you don’t drive very often, you may be tempted to wait until your car hits certain mileage markers to get an oil change. This isn’t necessarily a good idea, as oil can degrade over time. Change your car’s oil at least once a year to be safe.

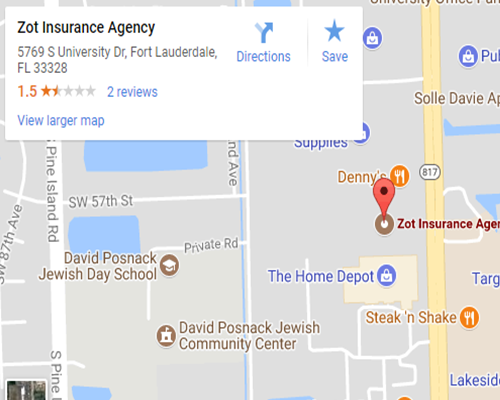

Zot Insurance Agency is Here for All Your Auto Insurance Needs

If you’re looking for a new car insurance policy, we’re here to help. At Zot Insurance Agency, we’re proud to serve Plantation, FL, and we can’t wait to help you find the right policy for your needs. Stop by our office or contact us today to learn more.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions