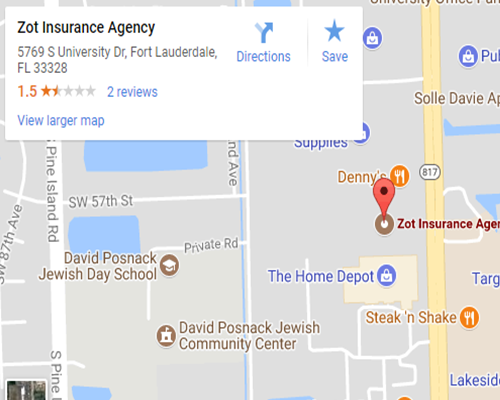

If you rely on commercial trucks to operate your business, you understand the importance of trucking insurance. Commercial trucking insurance protects your business and assets, offering financial support if one of your drivers is involved in a costly accident. As your business grows, you may have questions about trucking insurance that are critical to scaling successfully. For instance, can you bundle multiple trucks under one policy? Let’s explore how this works, the benefits it offers, and how you can find trucking insurance with the help of Zot Insurance Agency in Plantation, FL.

Can You Bundle Your Commercial Trucks?

As your fleet of commercial trucks expands, you may not want to purchase a separate insurance policy for every new truck. Fortunately, you can bundle them all under one policy, often referred to as fleet insurance. Fleet insurance simplifies the management of your trucks, reduces overall costs, and provides a customized policy tailored to the needs of your entire fleet. Additionally, fleet insurance offers effective risk management strategies that support your business, ensure continuity in the event of an accident (saving you from navigating through excessive paperwork), and reassure your clients that your business is well-covered. Bundling your commercial trucks is an excellent way to protect your growing fleet while streamlining your insurance needs.

Partner With Zot Insurance Agency to Protect Your Trucking Business

No matter how much trucking insurance you need or how many trucks you plan to insure, Zot Insurance Agency in Plantation, FL is here to help you get the coverage you deserve. Compare quotes with us today!

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions