You’re an independent trucker. You like it. You set your own hours. You don’t punch a clock or deal with dispatch. If you get your cargo from point A to point B in a reasonable time frame, that’s all you have to do, and the client gives you your paycheck. You do your job to the best of your ability, but some things are out of your control. You’ve got trucking insurance; that only makes sense. You may also want to consider cargo coverage.

What Is Cargo Coverage?

Just as trucking insurance covers any damage done to your truck, cargo insurance offers coverage against loss or damage to the freight while you’re delivering it. Did you hit a speed bump, and one of the TVs you were carrying got crushed? Did some of the fish you’re transporting spoil? Did a box of goods fall off the truck somewhere and was never recovered? Were you mugged at a truck stop for the entire contents of your truck? Did your truck get in an accident and the cargo damaged or lost? Cargo coverage ensures you are not fiscally responsible for any of these losses.

What Kind Do I Need?

If you drive a truck, you will need land cargo insurance. It covers collision, theft, and related risks. These kinds of policies are generally bound within national borders. Open cover cargo policies deal with various consignments, whether renewable or permanent. A contingency insurance policy is good for a situation where the customer is responsible for the damage or loss.

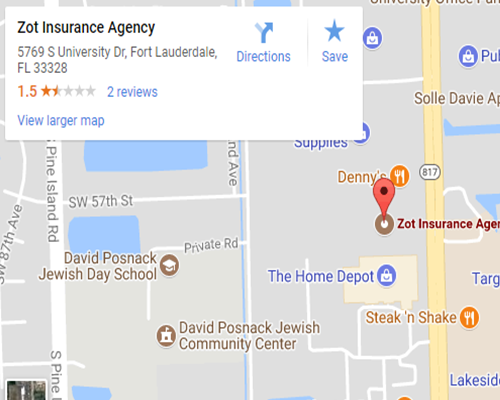

Contact Insurance Agency Serving Davie, FL

If you need trucking insurance or any other coverage for your trucking business and are in the Davie, FL area, please get in touch with Zot Insurance Agency. We’re here to help.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions