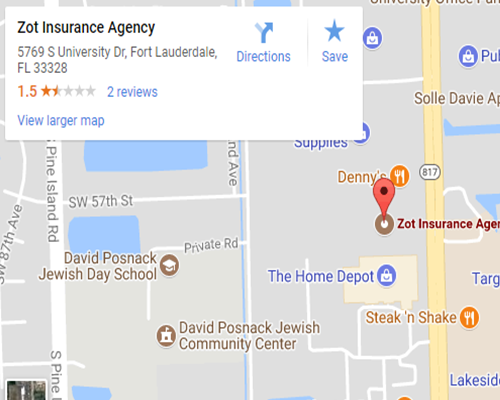

If you are an owner-operator driving a truck in Florida you need to know all there is to know about trucking insurance in Florida because your very livelihood relies on having your truck even if something bad happens. At Zot Insurance Agency we are happy to answer any questions you have about trucking insurance in Florida. We serve drivers in and around Davie, FL with quality insurance services.

Trucking Insurance Frequently Asked Questions

- How does trucking insurance differ from regular driver’s insurance? There are higher coverage limits, and the premiums can be higher as well. Regular driver’s do not come across the same risks that a trucker does and a good insurance policy will protect you and your livelihood in case of an accident.

- How much coverage do I need? In Florida, you are required to carry a minimum that starts at $10,000 but can grow significantly according to what your cargo is. Ask about specific coverage requirements for your situation. It is a good idea to go beyond the minimum requirements so you have more than minimum aid after an incident.

- Should I buy more than my employer covers? If you are not an owner-operator and are driving under your employer’s insurance policy it may be a good idea to buy an additional umbrella policy to protect yourself further. Discuss your options with our insurance agent, and possibly your employer to see if they want to fund part of your additional coverage.

Contact us at Zot Insurance Agency to learn more about trucking insurance or to purchase a policy. We serve Davie, FL and the surrounding areas with quality insurance services for all types of drivers. Do not let risk lay in your life or job, get the coverage you need at the price you want.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions