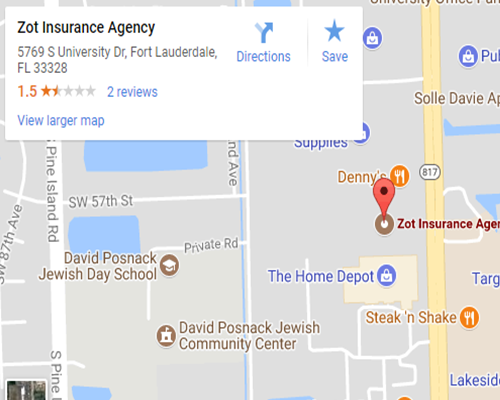

The gig economy is changing the way we earn money. Anyone with a skill and a bit of self-motivation can make a living doing a variety of tasks on their own schedule. The Zot Insurance Agency wants to help you make the most of your freelance career in the Davie, FL area. Commercial liability insurance is an important part of that.

How can these policies protect independent contractors in the gig economy?

- As an independent contractor, you are solely responsible for the results of your actions. If one of your direct-sales products makes someone sick, you could be held liable for medical payments and restitution. Your commercial general liability policy would help you pay for legal defense and defray the impact of any court-ordered costs.

- If you cause an injury or accident while doing work for another business, your client could be held liable for your actions. This could mean bad news for the future of your business. An active liability policy protects your client as well. In some industries, potential clients are more willing to hire contractors with liability coverage, since they know they’re covered too.

- Many gig workers engage in multiple money-making activities to make ends meet. Whether you’re stocking shelves for a major brand distributor or crafting handmade jewelry in your garage, your liability coverage will protect you. You won’t need a different policy for each of your roles. However, you may need additional coverage if you drive professionally.

The experts at the Zot Insurance Agency helps gig workers in the Davie, FL area safeguard the assets they work so hard to build. Let our agents assess your insurance needs and personalize a general liability policy for you. Contact us today to get started whether you live in Florida, Georgia, South Carolina, North Carolina, Tennessee, Alabama, or Texas.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions