Owning a second home in the Davie, FL area is a dream for a lot of people. While you may be excited to own a property that you can visit to enjoy the sun, warm weather, and a variety of local activities, it is important to remember that the property is a valuable asset that requires appropriate insurance coverage. There are a few reasons why you need to have insurance for your second home.

Coverage Protects Your Home

One of the main reasons that you need to have property insurance for your second home in this state is because it can protect your home. Anyone that buys a second property will be making a significant investment that they will want to last. To ensure that your home is protected, you need to have a home insurance plan that can be used to repair your property if it is damaged.

Coverage is a Requirement

Most people are also going to have specific home insurance requirements that need to be met. If you are going to own a second home, you likely will take out a mortgage and may also be part of a home association. In almost all cases, both your mortgage lender and the home association will require that you carry a full home insurance plan at all times. Having the proper coverage can help you stay in good standing.

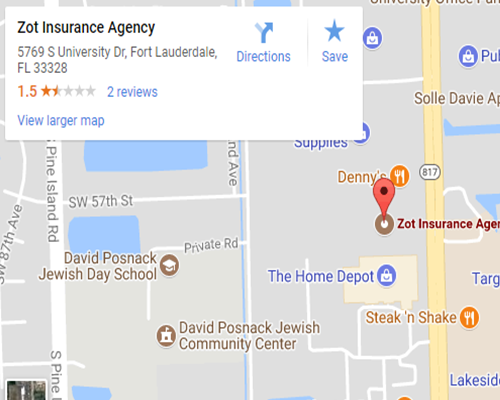

In the Davie, FL area, there continue to be a lot of second and vacation homeowners. As you are looking to buy a home here, you should speak with the Zot Insurance Agency to discuss your needs. If you do call the Zot Insurance Agency, you can learn a lot about your housing options and choose a plan that is ideal for your situation.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions