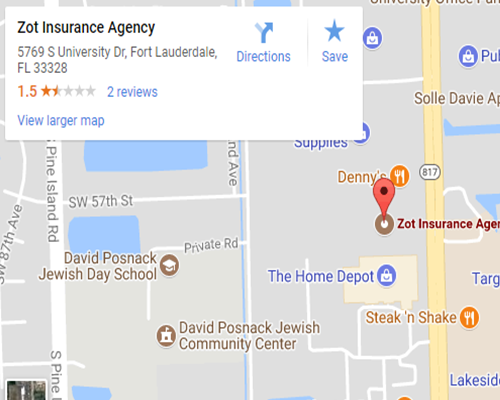

Commercial truck insurance is a tailored policy suitable for trucking risks. This insurance protects drivers and trucks on the road for owners of truck businesses and independent truck drivers, thus safeguarding your business. Zot Insurance Agency provides truck owners in Davie, FL, with the best coverage options for commercial truck insurance.

What You Need to Know About Commercial Insurance For Your Truck

Truckers have unique needs, which are accounted for in commercial truck insurance policies. If you want to be safe and keep your truck on the road, get your truck insured. The trucking policies start with primary liability and build on that foundation for additional policies, including general liability.

Commercial truck insurance is mandatory in most states. The Federal Motor Carrier Safety Administration requires truckers to show proof of insurance on the road to perform commercial activities. There are many risks involved with heavy cargo transport, and proper insurance helps shield you from monetary losses in these cargo damage cases due to road fatalities.

Buying The Right Commercial Truck Insurance

Commercial truck insurance is a big and key investment for anyone with a truck business. Before purchasing this policy, it’s important to understand what they entail to know the level of coverage offered. You can get multiple quotes from agents specializing in truck insurance to determine what best suits your business needs.

Determine the type of commercial insurance that best protects your assets in cases of negligence claims and malpractices. Choosing a reputable insurance company with enough experience and reserves is important to cater to insurance claims.

What Is Covered In Commercial Truck Insurance?

Truck businesses have unique safety needs. Commercial truck insurance policies cover general liability, workers’ compensation, and commercial umbrella insurance for truckers.

If you want to cover all fleet damages and protect yourself against losses occurring on the roads, get commercial truck insurance from Zot Insurance Agency serving Davie, FL. Contact us to protect your truck business against unforeseeable losses.

Contact

Contact

Email an Agent

Email an Agent

Click to Call

Click to Call Get Directions

Get Directions