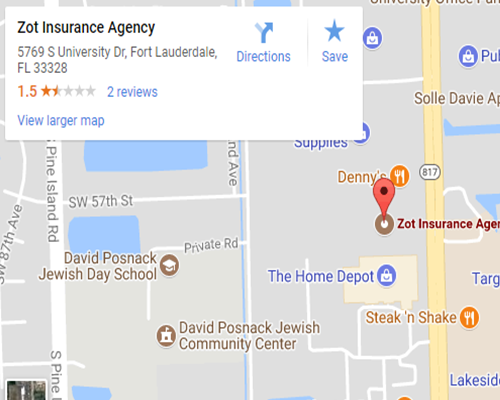

An auto insurance policy is practically a nationwide requirement. So, if you were to simply move somewhere else, you wouldn’t need to change your insurance policy, right? Nothing would fundamentally change when you moved. While this seems logical, the reality is that a lot can change when you decide to move somewhere new, and keeping your policy up-to-date is essential to getting the coverage you need to stay safe on the road. Let’s look at how auto insurance changes when you move, what you need to do should you move to somewhere new, like Plantation, and how to get the right coverage with us at Zot Insurance Agency, serving Plantation, FL.

How Does Auto Insurance Change When You Move?

Location matters a great deal when it comes to location. For example, your auto insurance provider will be looking at what traffic looks like in your area, risk factors like accident frequency and crime, and weather patterns, all of which help them determine rates. For example, if you move to an area with higher crime, more frequent accidents, and weather patterns that could lead to accidents, your premiums will rise. A new location may also mean that you have to drive further to get to work or require different coverage minimums if you move to a new state. Put simply, a lot can change when you move. If you want to make sure you’re fully covered and aren’t running the risk of claim denial, always update your auto insurance provider whenever you move to a new house. Alternatively, you may need to shop for a new policy if you move to an entirely different state.

Get Auto Insurance Coverage for Your Move With Zot Insurance Agency

Are you planning a move and need new auto insurance? Alternatively, are you shopping for auto insurance in general? No matter the reason, we here at Zot Insurance Agency, serving Plantation, FL, are always ready to help you shop around for auto insurance in your area. Compare quotes with us to get started.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions