Welcoming a new pet into your home can be an exciting opportunity. There is a great deal of planning that goes into the process, and you need to think about what the change to your home will mean. What you may not have thought about is the impact on your home insurance policy.

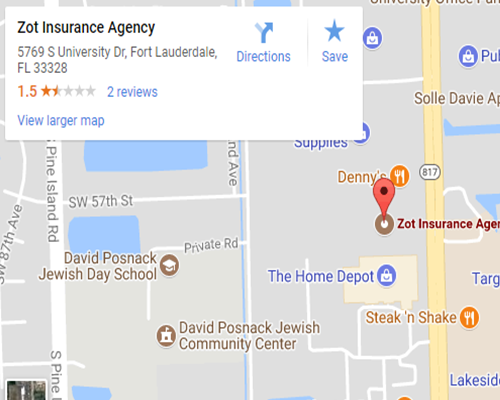

It is not always necessary, and having a pet does not always affect your home insurance policy, coverage, or rates. However, it is wise to contact your insurance company to let them know about your pet. If you are looking for updated home insurance in or near Plantation, FL, our team at Zot Insurance Agency can offer you the help you need.

Why a Pet Matters to Your Home Insurance

If you are bringing a new dog into your home, you are increasing the risk factors present to those who visit it. While most dogs are not threats and do not pose a risk to others in most situations, there are times when they can be seen as a concern to insurance companies. In short, if your dog bites someone at some time in the future, for any reason, you will likely want your home insurance policy to cover your losses, including the medical bills and other claims made by the victim. If your insurance company does not know you have a dog, they cannot provide you with the protection you expect.

Let Your Agent Know

To avoid risks at your home in or near Plantation, FL, contact your home insurance company now to let them know whether you have a pet and what your needs are. At Zot Insurance Agency, we work to help our clients have coverage that matches the risks they face. That includes coverage for all of the risks involved with having pets.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions