It’s always a good idea to keep your car insurance current. Having insurance protects you and the people you encounter. Nobody plans on having an accident, and having insurance makes sure that there are procedures that can take care of everyone when something unfortunate happens.

Lapsed Insurance

Unfortunately, some people in Davie, FL have allowed their auto insurance to lapse. Sometimes, it’s an accident, such as moving and forgetting to update your information for renewal. Sometimes, it’s deliberate because people think they can’t afford it. However, the cost of getting caught without insurance is usually more than that of continued coverage, especially if an accident occurs.

When you are in an accident in Davie, FL, you are required to provide proof of insurance. The Florida Department of Highway Safety and Motor Vehicles (FLHSMV) may even receive the information directly from your insurer if you allow your insurance to lapse.

Legal Consequences

You will have an opportunity to prove that you did have insurance, but the first offense under the law for not having insurance is $150. You may also face suspension and have to pay reinstatement fees. A second offense within three years will cost $250, while a third offense will run you $500. You also face a suspension on your registration, and you may be unable to register your vehicle for three years.

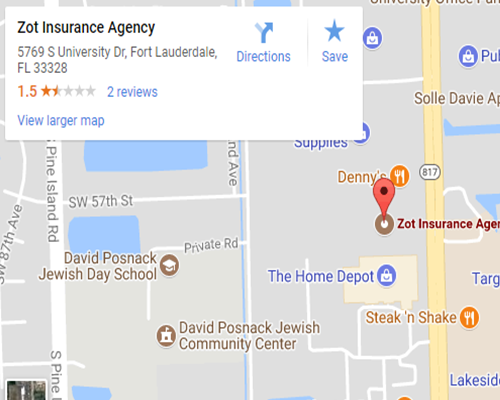

You also want to consider that if you allow your insurance to lapse, your new insurance company will notice the lapse when you try to get auto insurance again. Considering all the potential problems if your insurance lapses in Davie, FL, it is best to find a way to keep your coverage current if at all possible. If you need help or have questions about auto insurance, please call Zot Insurance Agency today.

Contact

Contact

Email an Agent

Email an Agent

Send us a Text

Send us a Text Click to Call

Click to Call Get Directions

Get Directions